Meet Mr. Dow & Mr. Jones

It was a four-day train ride to Colorado in 1879 that put the journalist Charles Henry Dow on the track that would come to be his life’s work. His editor had sent him off to interview a group of industry magnates, politicians, and investors, who were about to investigate the possibilities of developing silver mines in the city of Leadville. It was an eventful journey, and the delegation ate and drank a lot of whisky while the steam train huffed its way through the countryside. They traded stories, smoked big cigars, and played cards. It was a journey, during which the young reporter learned a lot about the financial world. But the world was not for everyone. As he wrote: “You need to be willing to take the chance – and to take the loss.”

Already the next year he moved to New York, where he nine years later founded The Wall Street Journal, which today is a respected daily newspaper with a circulation of over two million copies. He focused on the business and financial content, which was written with the motto: ‘The Truth in its proper use’. Not least of all did he promise a trustworthy newspaper, in which the contents by no means were guided by the advertisers.

Meet Mr. Jones

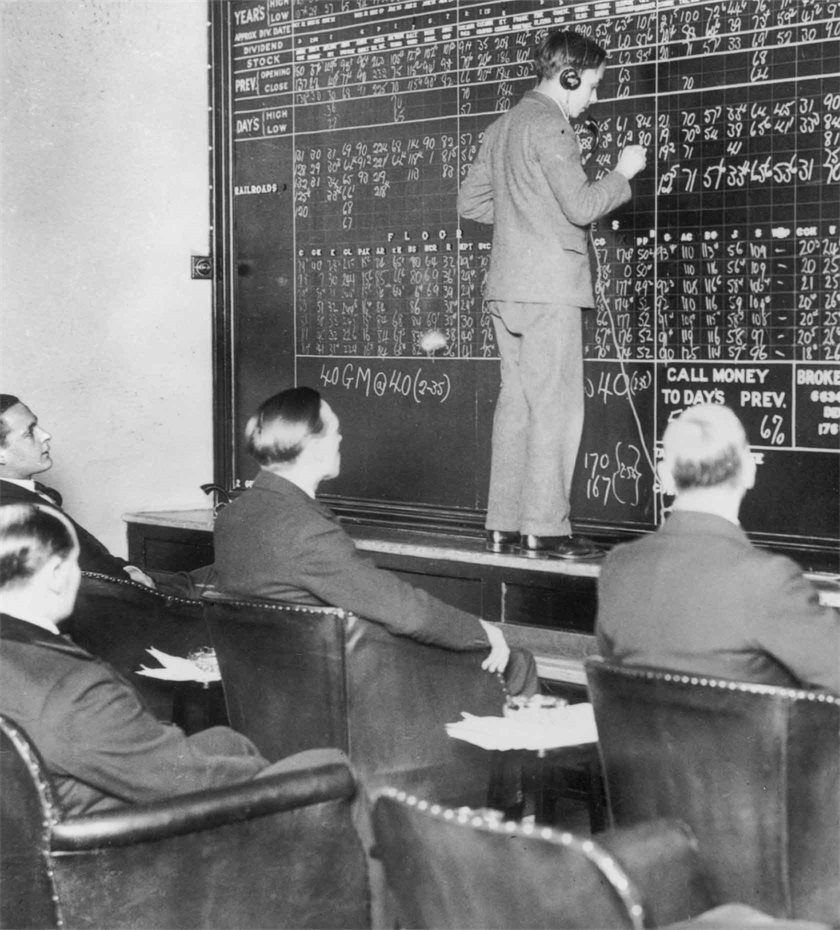

In New York, he met the journalist and statistician Edward Jones, and together they created the first stock market index in an attempt to deliver trustworthy information to investors. In the beginning, it was a daily newsletter consisting of only two pages describing the development of the stock prices of 12 railroad companies and industrial companies. It was the precursor of the Wall Street Journal.

Over the years they refined their methodology, and in 1896 they could publish the Dow Jones Industrial Average. For 125 years they have created snapshots of the largest American industrial companies’ financial health. Later, the number was increased from 12 to encompass the 30 largest companies. But the foundation of the Dow Jones methodology is still to add and plot the stock market indexes together and divide by the number of companies.

Not a Thermometer

Despite new – and sometimes more precise - stock market indexes, such as Nasdaq and S&P 500, Dow Jones is still valid. That says serial entrepreneur and financial investor Lars Tvede. “Even though Dow Jones historically has given us snapshots of both financial rises and falls, it is a tool that’s still being used. It shows how the money is flowing in the aftermath of shockwaves, for example the Covid-19 pandemic, wars, and stock market crashes like the one in 1929. But what people usually forget is that Dow Jones isn’t a thermometer telling us about the current economy. It’s a barometer, telling us something about the development of the future economy.”

The historical development described by the Dow Jones index remains impressive. When the index summed up the stock market on its first day on Wall Street, it had a closing price of 40.94. Today, the market value of the stocks has risen to 34.400 – or an increase of 80.000%. For several years the Dow Jones index was simply considered an indicator of the financial health. And not least of which direction it was headed.

Times are Changning

Even though the Dow Jones index still is calculated daily, the world has changed since the day in May in 1896 when it was first published. “Historically, Dow Jones has also been through a dramatic change. In earlier days, the index consisted of the big oil companies and the heavy industry, today it’s the tech giants, such as Microsoft and Apple, that are in the top.” Lars Tvede says.

Despite some stock market analysts describing the Dow Jones index as a bad starting point for investments, the Dow Jones index is still important: it started the trend of looking at the stock market in another manner than just focusing on the single companies. It was the first tiny step to get investors to become interested in risk diversification. A concept that did not get much attention in the early 1900s.

The road to our modern-day stock exchanges has been turbulent for the Dow Jones index. It has survived 23 American presidents, 25 recessions, 2 world wars and who knows how many stock market crashes – not least the crash in 1929. Charles Henry Dow died relatively young at the age of 51 in 1902. The company, founded by him and his partner Edward Jones – Dow Jones & Company – was sold to Rupert Murdock News Corporation for almost five billion dollars in 2007.

Is Greed Still Good?

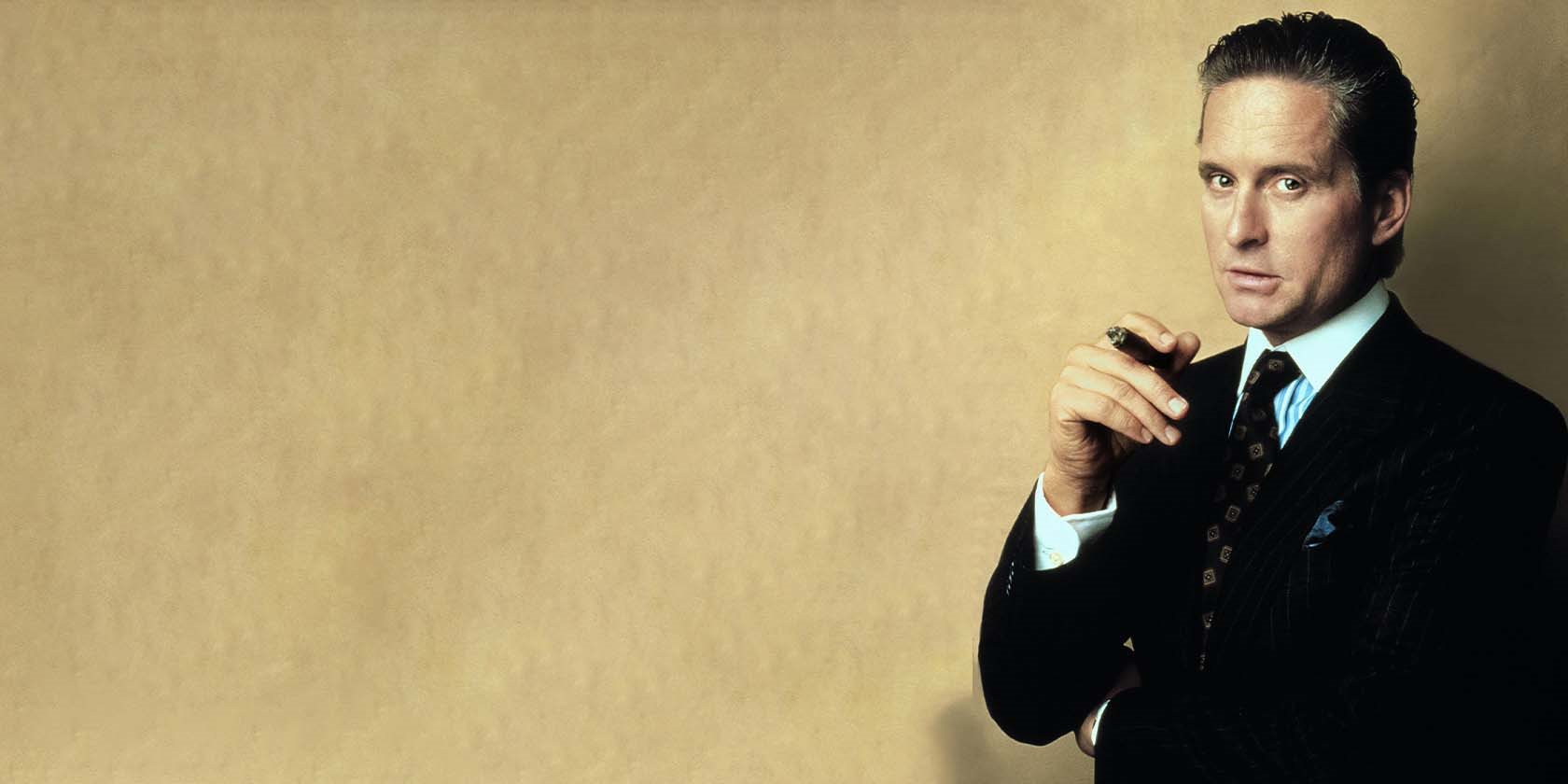

Oliver Stone’s movie Wall Street from 1987 exposed the greediness of the eighties’ yuppie generation. The movie, starring Michael Douglas as the hardened stock market speculator Gordon Gekko, was a warning against a toxic culture. But did we learn our lesson?

If the 1980s despite everything is a little too far off in the mists of memory, here is some help: It was an era ruled by the yuppies. These Young Urban Professionals became the definition of the egoism and greed of the time. It was also a time during which the actor Ronald Regan suddenly became president. And not least a time during which the economy boomed: in five years, from 1982 to August 1987, the Dow Jones index market price rose from 776 to 2.722. It was a time which gave birth to several new millionaires. Right up until the stock market index took a nosedive on Black Monday. That was October 19, 1987. A black day, and Dow Jones could register the single biggest fall in one day. The value of the 30 companies in the Dow Jones index suddenly lost 22.6%.

Two months later, the Oliver Stone movie Wall Street opened in theaters, starting Michael Douglas in the lead as the super greedy and unscrupulous stock market speculator Gordon Gekko, who uses any trick in the book to quickly score a profit on the stock market. Seldom has a movie premiere been so well-timed! At one point in the movie, he says: “Greed, for lack of a better word, is good. Greed is right. Greed works.” It became a mantra for understanding the financial fall that followed. And maybe the spirit of the eighties, too.

The character of Gordon Gekko is said to have been inspired by the real-life stock trader Ivan Boesky, who the week after the movie opened was sentenced to three years in prison for insider trading. And in the movie world, Gordon Gekko, aka Michael Douglas, also ends up behind bars. The Wall Street movie was Oliver Stone’s unambiguous description of a toxic culture in New York’s stock trade environment. But the movie had the opposite effect and became close to a cult movie, inspiring a coming generation of stockbrokers, who did not seem to have learned the Black Monday lesson from 1987. Maybe there were other reasons, but nonetheless, the 1987-crash seemed to repeat itself with the financial crisis 2007-8. Again, the banks and stockbrokers were accused of being greedy to a level that was beyond a regular person’s grasp.

Olive Stone said in 2015, in the aftermath of the financial crisis, that the Wall Street culture today is much worse than it was in the 1980s. The movie from 1987 contained a warning about the financial nightmare that could take place in the future. A warning that was not heeded. In 2010, Stone directed the movie Wall Street: Money Never Sleeps. In this movie, Gekko has gotten something reminiscent of a sense of responsibility and morals. But maybe it is the original Wall Street movie which contains the most important message, which is that greed leads to self-destruction. A message which is probably wasted on those who found the story about Gordon Gekko something worth celebrating.